The Steady March Towards Climate Risk Disclosures in Australia

Last week, the Australian Prudential Regulation Authority (APRA) released draft guidelines on managing the financial risks of climate change for Australian banks, insurers and superannuation trustees.

This is an important document for APRA-regulated entities. In 2017, APRA recognised climate risk as “foreseeable, material and actionable now”, and has been highlighting the financial nature of climate change risks for several years. The release of these draft guidelines is the latest in a number of developments, both in Australia and abroad, that pace out the steady march towards better regulation of climate-related financial disclosures in the financial services sector, and the move towards incorporation of climate risks at the heart of business risk modelling.

What is climate risk?

Climate risk refers to the financial risks arising from climate change, including the physical, transition and liability risks (Figure 2). Over the past several years, there has been increasing interest in understanding these risks (and opportunities) to business operations and investments.

Physical risks refer to the impact of changing climate conditions on asset integrity and business interruption. These may be via extreme weather events, such as floods or bushfires, or chronic climate stresses, such as water availability or heat stress. Physical risks can result in lower asset values, defaults on loans, or the increasing price of insurance, and can manifest either in-situ or inherited through the supply chain. Catastrophe loss models, used extensively within the reinsurance industry as a decision support tool to assist in pricing weather risk and aggregate exposure management, are well placed to measure the financial impacts of physical climate risk on a company’s asset portfolio as they have been doing so for ‘present-day’ conditions the past three decades.

Secondly, transition climate risks broadly encompass those risks (and opportunities) posed to a company through economic decarbonization. These include changes in domestic and international policy, technological innovation, social adaptation and market changes, which can all result in changes to costs, income and profits, investment preferences and asset viability.

Finally, liability risk refers to the implications of physical and transition climate risk for businesses and directors’ duties. While not a material risk to the company per se, it is often a driver for action on climate risk at the board level. Liability risks stem from the potential for litigation if institutions and boards do not adequately consider or respond to the impacts of climate change.

Why is climate risk important for business?

The financial risks associated with climate change may have a compounding effect on a range of other business risks, including:

- Credit risk (e.g., default on loans);

- Market risk (e.g., re-pricing of financial instruments);

- Operational risk (e.g., supply-chain disruption);

- Underwriting risk (e.g., increase in insured natural catastrophe losses);

- Liquidity risk (e.g., difficulties in liquidating assess negatively affected by climate risks), and;

- Reputational risk (e.g., changing customer and investor expectations around climate risk).

However, APRA notes that the financial risks associated with climate change have several elements that distinguish them from other financial risks, including:

- The potential for irreversible changes in climate;

- The potential for climate risks to manifest across multiple lines of business at the same time;

- The uncertain and extended time horizon over which climate risks may materialise, which is likely to extend beyond typical business planning cycles, and;

- The unprecedented nature of climate change – meaning traditional backward looking risk assessment methods are unlikely to be adequate to anticipate future impacts.

What did APRA say?

APRA’s Prudential Practice Guide (PPG) on Climate Change Financial Risks is delivered in a similar four-pillar approach to the pre-existing and widely used Taskforce of Climate-Related Financial Disclosures (TCFD). These are Governance, Risk Management, Scenario Analysis and Disclosure. Indeed, through the guide, APRA considers the framework established by the TCFD to be a sound basis for disclosing climate change financial risks and provides guidance that is broadly aligned with TCFD. Some of the key takeaways from APRA’s PPG on climate risk include:

Governance – Climate risks should be managed within an institution’s overall business strategy at a senior management level, with board oversight when they are deemed to be material.

Risk Management – A running theme is the need for institutions to form an understanding of the extent to which climate impacts may be material to the institution’s own risks. APRA suggest a prudent way to begin this journey would be to identify economic sectors and geographies with higher or lower exposures to physical and/or transition climate risks, in order to develop sector-specific policies and procedures when undertaking business engagements with those sectors.

Scenario Analysis – There is encouragement throughout the guide to adopt a scenario-based and stress-testing approach to understanding climate risks. Specifically, scenarios should look to inform risk identification in both the short-term (in line with current business planning cycles), and then a long-term assessment extending to 2050 or beyond. The long-term assessment may include at least two different warming scenarios for assessing physical climate risks (e.g., a plus-four-degree, business-as-usual scenario, and a sub-two-degree, Paris-aligned scenario) and two socio-economic scenarios for assessing transition climate risks (e.g., an orderly and disorderly transition to a lower-emissions economy).

Disclosure – APRA considers the framework established by the TCFD to be a sound basis for producing information that is useful for an institution’s stakeholders and anticipates the demand for climate risk disclosure will increase over time.

These four pillars are used to guide a prudent climate risk management approach, which looks to identify the materiality of climate risks (and opportunities) on business activities via the incorporation of these into financial impact modelling (Figure 3).

How are organisations already disclosing their climate risks?

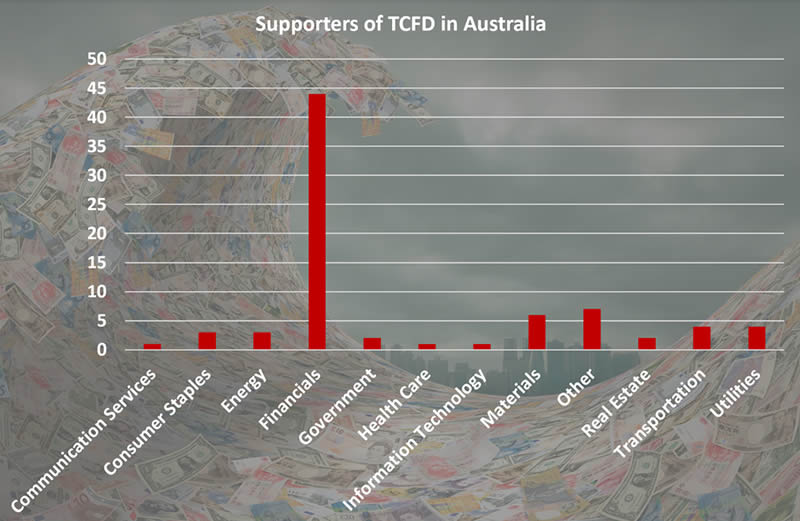

APRA’s recent guidance on climate risks is one in a line of regulatory announcements both in Australia and abroad that indicate a move towards a more standardised and structured climate risk disclosure framework. In September 2015, Mark Carney, then Governor of the Bank of England, coined the phrase of climate risk being the “tragedy of the horizon” and shortly after draft (2016) and final (2017) recommendations of the TCFD were published. Since then, both APRA and ASIC (Australian Securities and Investments Commission) have come out in support of TCFD and many listed organisations in Australia are already disclosing against these principles (Figure 4). The vast majority of these are in the financial services sector (Figure 5). Most recently, New Zealand and the UK have indicated that climate risk disclosures will become a legal requirement for many listed companies in the coming years. Similar legislation may follow in Australia.

Risk Frontiers’ approach to modelling the financial impacts of physical climate risk

Risk Frontiers has been developing detailed natural catastrophe loss models for the past 27 years for all major, loss-producing extreme weather events in Australia. These models are able to put a dollar value on present-day extreme weather risk to a portfolio of real assets. Using the latest climate science, we can now also model the change in financial losses for future climate scenarios. These models give a detailed view of changes to physical climate risk for a company asset portfolio through time.

For initial risk scoping applications, our Address-Based Natural Hazards and Climate Risk Rating Database (RRD) provides a present and future physical climate risk score for every address in Australia, encompassing both acute (extreme weather) shocks and chronic climate stresses. Importantly, our risk scores comprise both the hazard (climate) and vulnerability (built environment) components of physical climate risk. Assets are being mapped to listed company tickers, meaning company, investment portfolio and sector-based scores, and comparison to benchmarks, are all possible for ESG applications.

For more information, contact info@riskfrontiers.com.