Using catastrophe loss models to improve decision making in disaster management

Catastrophe loss models

Catastrophe loss models are decision support systems used extensively in the (re)insurance industry to assist in pricing risk and aggregate exposure management. They also offer significant benefits in improving disaster risk reduction decision making.

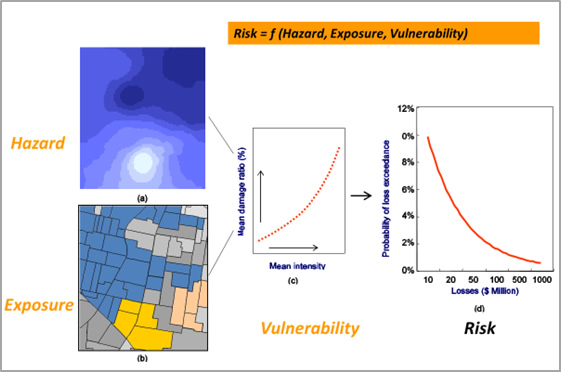

Risk Frontiers over the last 25 years has developed a sophisticated suite of Australian probabilistic catastrophe loss models to quantify the impacts of flood, bushfire, hail, tropical cyclone and earthquake. These risk models have nationwide coverage and are comprised of the following modules (see Figure 1):

- Hazard – estimates the hazard intensity footprint for a specific event. For example, flood extent or ground shaking intensity.

- Exposure – provides location-based information about relevant assets.

- Vulnerability – estimates the level of financial loss to different types of property as a function of hazard intensity.

Risk Frontiers’ catastrophe loss models provide scientifically based damage estimates to insurable assets such as residential, commercial and industrial properties and provide users with information about possible financial losses and associated average recurrence intervals (ARIs). Standard outputs from the financial module include exceedance probability (EP) curves (return periods) and average annual losses (AALs).

Using a suite of models enables the comparison of possible losses between hazards at various ARIs for a given geographic area (Figure 2). Loss estimates can also be used to inform benefit cost estimations of different disaster risk reduction investments by varying the vulnerability module1.

In addition to estimating financial losses, model outputs can be combined with vulnerability functions that enable the estimation of loss of life and infrastructure disruption.

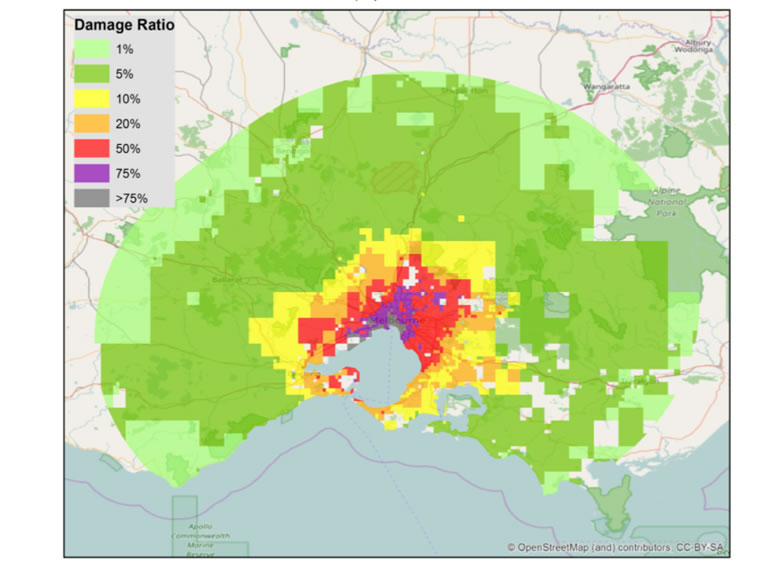

Catastrophe loss models can be used to inform disaster planning and capability analysis by enabling the development of ‘what if’ scenarios. For example, to estimate the impact of a magnitude 7 earthquake occurring underneath Melbourne (Figure 3). The models can also be used before or during actual events to forecast possible impacts.

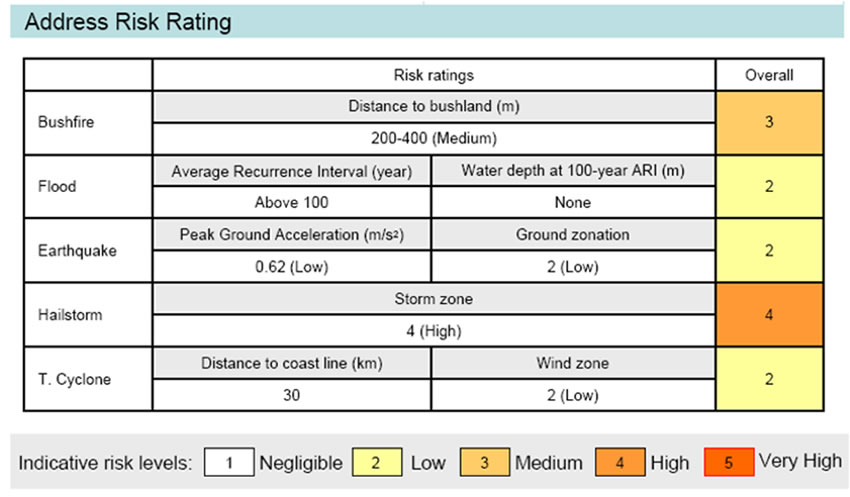

Risk Frontiers combines output from its hazard modules with other data sources to maintain a multi-hazard database for Australia (Figure 4). This database provides national address-based risk ratings for flood, bushfire, earthquake, severe storms, storm tide, tropical cyclones and other hazards. It can be used to assess risk across national asset portfolios, identify community risk profiles and inform property owners of their natural hazard risk profile.

1 Walker, G. R., M. S. Mason, R. P. Crompton, and R. T. Musulin, 2016. Application of insurance modelling tools to climate change adaptation decision-making relating to the built environment. Struct Infrastruct E., 12, 450-462.

Understanding future risk

The catastrophe loss modelling framework is ideally suited to consider influences on future risk such as climate change, mitigation investment, increased development and changes to building codes. The Geneva Association, a peak insurance industry think tank, concluded that by combining catastrophe models with latest climate science an enhanced understanding of future weather-related risk impacts could be developed. Such use provides greater insights into the impacts of climate change on natural hazards not currently possible using Global Climate Models.

Risk Frontiers’ Australian catastrophe loss models

FloodAUS. FloodAUS is based on the National Flood Information Database. The scope of the model is further extended using Risk Frontiers’ Flood Exclusion Methodology. Correlations between catchments are modelled to provide estimates of total event losses.

FireAUS. The upcoming release uses MODIS Burnt Area Products along with other data sources, machine learning models and fire-tracking algorithms to derive a national synthetic event set from which losses are calculated.

QuakeAUS. QuakeAUS is a national earthquake model for Australia. Starting from a record of historical seismicity, it uses a ground motion prediction model developed specifically for Australia. A major update of the model has been completed to incorporate Geoscience Australia’s recent revision of the National Seismic Hazard Assessment, including a revision of the Australian Earthquake Catalogue. It also includes for the first time an active fault model.

HailAUS. HailAUS is a loss model for hail with nationwide coverage. It includes a catalogue of hailstorms reflecting the frequency and severity of ‘high storm potential days’ derived from reanalysis data and the observed historical record. In addition to calculating damage to property the model includes a motor vehicle damage estimation module.

CyclAUS. CyclAUS is a tropical cyclone wind loss model for Australia. It covers the entire region at-risk of tropical cyclone. Detailed vulnerability functions enable the estimate of loss.

For further information contact Andrew Gissing at andrew.gissing@riskfrontiers.com